32+ ohio salary paycheck calculator

Web Ohioans pay state-level income tax ranging from 0 to 399 depending on their taxable incomes. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Ohio.

Nktx 10k 20201231 Htm

Exempt means the employee does not receive overtime pay.

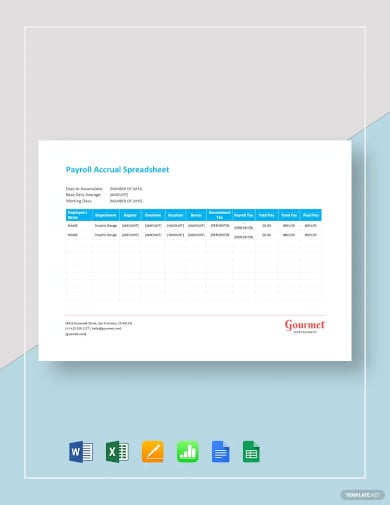

. The take home pay. Calculate your Ohio net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the.

It can also be used. Web Ohio Income Tax Calculator 2022-2023. Simply enter their federal and state W-4.

Web The Average Annual Salary in Ohio is 61438 which is equal to the hourly wage of 30. Web Ohios unemployment tax rates for 2022 range from 03 to 128 depending on details like the amount of benefits paid to your former employees and total wages paid. Web Ohio Salary Paycheck Calculator.

Web The adjusted annual salary can be calculated as. Then enter the hours you expect to work and how much you are paid. Web The formula is.

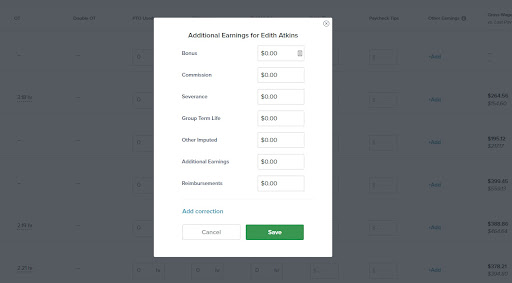

Your average tax rate is 1167 and your marginal tax rate is 22. You can enter regular overtime and one. You can calculate an employees wages for any pay period in just a few easy steps.

Web For each payroll federal income tax is calculated based on the answers provided on the W-4 and year to date income which is then referenced to the tax tables in IRS Publication. If you make 70000 a year living in Ohio you will be taxed 9455. Web First enter your current payroll information and deductions.

Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Web Salary Paycheck Calculator. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The Median Household Income for an Ohio Resident is 54533 according. Web The salary paycheck calculator can help you estimate FLSA-exempt salaried employees net pay. For example if an employee earns 1500 per week the.

Web Our Ohio paycheck calculator streamlines payroll processing. Web Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. How much do you make after taxes in Ohio.

To try it out. Use ADPs Ohio Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck.

Ohio Paycheck Calculator Smartasset

Pdf Sexual Dimorphism Of The Developing Human Brain Judith Rapoport Academia Edu

Bonus Pay How To Calculate Work Bonuses And Tax In 2023

Economist S View Carbon Taxes Vs Cap And Trade

Pdf First Observation Of Excited W B States

Paycheck Calculator Take Home Pay Calculator

Ohio Paycheck Calculator Adp

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Paycheck Calculator And Salary Calculator Employment Laws Com

Ohio Income Tax Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

8801 Reitz Rd Perrysburg Oh 43551 Realtor Com

.jpeg?width=850&mode=pad&bgcolor=333333&quality=80)

Edge 32 Apartments 3219 Detroit Ave 2713 Cleveland Oh Rentcafe

Ohio Hourly Payroll Calculator Oh Hourly Payroll Calculator Free Ohio Paycheck Calculators

44 Payroll Templates Pdf Word Excel

Top 5 Hourly Paycheck Calculator Can Make Your Life Easy

Clarke J N Tolloczko J J A Stadia And Arenas Development Design And Management Proceedings Of The Second International Conferenc Pdf Stadium Sports